Let’s be honest. For many millennials, personal finance feels like a part-time job we never applied for. We’re navigating student loan debt, a wild housing market, and the constant, low-grade anxiety of whether we’re “on track.” Traditional budgeting? It often feels like trying to fix a leaky pipe with duct tape.

But here’s the deal: a new wave of AI-powered personal finance tools is changing the game. These aren’t just fancy spreadsheets. They’re like having a hyper-organized, non-judgmental financial co-pilot right in your pocket.

Beyond the Spreadsheet: What Exactly Is an AI Finance Tool?

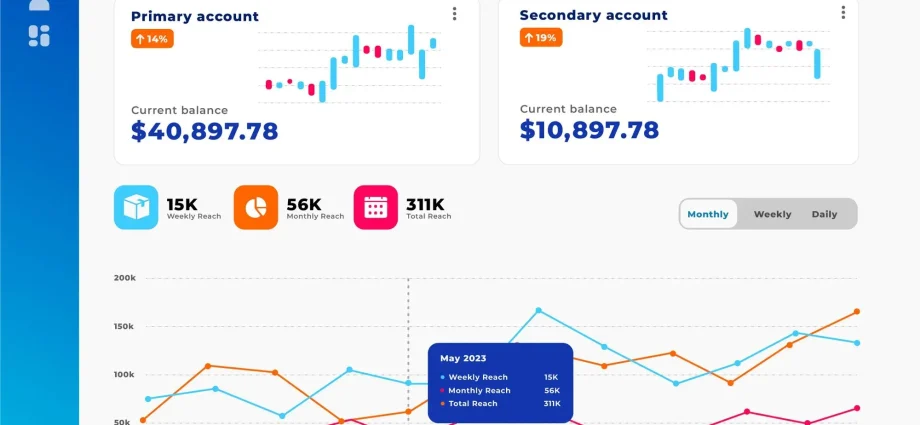

Think of it this way. A basic budgeting app tells you what you spent. An AI-powered tool tells you why you spent it, how it fits into your larger goals, and what you should probably do next. It learns from your behavior, spots patterns you’d never see, and automates the tedious stuff.

It’s the difference between a map and a GPS that recalculates your route in real-time to avoid traffic. Both are useful, but one is actively guiding you.

The AI Toolbox: Key Features You’ll Actually Use

So, what can these digital assistants actually do? Well, a lot. They’re built to tackle the specific pain points of a generation that’s comfortable doing everything on their phone.

Hyper-Personalized Budgeting & Spending Insights

Forget manually categorizing that late-night taco run. AI automatically sorts your transactions with scary accuracy. But it goes deeper. It’ll notice if your grocery bill creeps up, alert you that your subscription services are quietly draining your account, and even predict your cash flow for the month ahead.

It’s like having a financial detective on your side, one that connects the dots between your daily coffee habit and your savings goals.

Automated Saving and Investing (The “Set-and-Forget” Method)

Willpower is a finite resource. AI-powered micro-investing and saving apps remove the need for it entirely. They use algorithms to analyze your income and spending, then silently sweep small, “safe-to-save” amounts into your investment or savings account.

You know that spare change from rounding up transactions? Or that little bit left over before payday? The AI finds it and puts it to work. You barely notice it’s gone, but your future self will thank you.

Tackling the Debt Dragon

Student loans. Credit card debt. It can feel like a dark cloud. AI tools can cut through the overwhelm by creating a optimized, personalized debt payoff plan. They’ll run the numbers to show you whether the avalanche or snowball method is better for your situation, and then track your progress, celebrating those little wins with you.

It turns an emotional burden into a logical, manageable project.

Your 24/7 Financial Q&A Chatbot

Is it better to pay off my car loan early or invest? What’s a Roth IRA? Instead of falling down a Google rabbit hole, you can now ask these questions to an AI chatbot trained on financial data. You get instant, plain-English answers without the sales pitch. It’s like having a patient, know-it-all finance professor in your back pocket.

A Quick Look at What’s Out There

| Tool Type | What It Does | Good For… |

| Comprehensive Managers (e.g., Copilot, Monarch) | All-in-one dashboard for budgeting, net worth, subscriptions, and insights. | The person who wants a single source of truth for their entire financial picture. |

| Automated Investors (e.g., Acorns, Wealthfront) | Focuses on micro-investing and portfolio management using algorithms. | Beginners or busy people who want to start investing without becoming experts. |

| Debt Strategists (e.g., Undebt.it) | Creates and tracks customized debt payoff plans. | Anyone feeling crushed by multiple debt payments and needing a clear path out. |

| AI Chat Assistants (e.g., GPTs within apps) | Answers complex financial questions in real-time. | The curious user who wants to learn and make informed decisions on the fly. |

But… Is It Safe? Addressing the Elephant in the Room

Trusting a robot with your bank login? Yeah, it’s a valid concern. The best AI finance apps use bank-level, read-only encryption. This means they can see your data but can’t move your money. They act as a brilliant analyst, not a bank teller.

Always, always check for:

- 256-bit SSL encryption (the same stuff banks use).

- Clear privacy policies that state they won’t sell your data.

- Positive reviews and a solid reputation. A little research goes a long way.

The Human Touch in a Digital World

For all their brilliance, these tools have a ceiling. They are fantastic for optimization, pattern recognition, and automation—the tactical side of money. But they can’t replicate the nuanced, emotional intelligence of a human financial advisor for complex life events like estate planning or navigating a sudden windfall.

The goal isn’t to replace human judgment. It’s to use AI to handle the grunt work, freeing up your mental energy for the big, strategic decisions. It’s about working smarter, not just harder.

So, where does this leave us? We’re at a fascinating crossroads where technology is finally catching up to our financial anxiety. These tools are demystifying money, making it less of a source of stress and more of a tool for building the life you actually want. They’re not a magic bullet, but they are a powerful ally. In the end, the AI provides the data, the insights, the automation… but you’re still the one in the driver’s seat.